Hoplite Agency – Trusted Guidance, Tailored Solutions.

About Juan C. Valdes

I’ll never forget watching my grandparents struggle with Medicare. The endless mail, nonstop calls, and all that fine print—it was overwhelming. And when they had questions, they got passed around with no real answers. I saw their frustration up close. They just wanted honest help, but the system made it feel impossible.

That’s when I knew I had to step in—not just for them, but for anyone feeling the same way.

Since then, I’ve helped countless others find plans that truly fit their needs. There’s nothing better than seeing that look of relief when someone knows they made the right decision and finally feels confident in their coverage.

When my grandfather passed, we experienced firsthand how powerful final expense insurance can be. Because he had a policy, we didn’t have to scramble or stress about funeral costs. We were able to come together, grieve, and honor his life without that financial burden.

Today, I make Medicare simple, clear, and personal. And I help families plan ahead—so when the time comes, they can focus on love and healing, not how they’re going to afford it.

What kind of products do you offer?

Hoplite Agency LLC and it's associates offer Medicare Supplements, Medicare Advantage, Prescription Drug Plans, Individual Marketplace Health Plans, Final Expense Life Insurance, Term Life Insurance, Whole Life Insurance, Hospital Indemnity Plans, Cancer/Heart Attack/Stroke Plans, Accidental Coverage, and more.

Am I eligible for Medicare?

To be eligible for Medicare, you. must be a U.S. citizen or legal resident and you must meet one of these requirements:

Age 65 or older

Younger than 65 with a qualifying disability

Any age with a diagnosis of end-stage renal disease or ALS (Lou Gherig's disease)

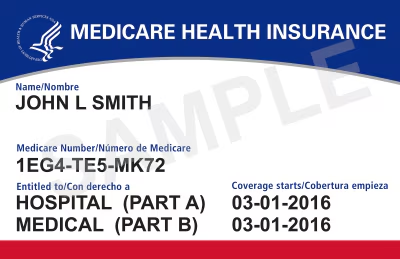

You should be automatically enrolled in Medicare Part A and Part B if you're receiving Social Security or Railroad Retirement Board benefits when you become eligible. You'll receive your Medicare card in the mail.

If you aren't receiving Social Security or Railroad Retirement, you'll need to enroll yourself in Medicare when you become eligble. Go to ssa.gov/benefits/medicare to enroll online, or call or visit your local Social Security Office.

*** If you have a disability or medical condition you will automatically be enrolled in Medicare Parts A and B after your 24th month of disability. You will still have a 7-month IEP. Enrollment timing for people with ESRD or ALS is based on the time of diagnosis and other factors. ***

I'm turning 65, what next?

You have a 7-month Initial Enrollment Period (IEP) for Medicare. It includes the month you turn 65, the 3 months before and the 3 months after. It begins and ends a month earlier if your birthday is the first day of the month.

Your coverage begins the first day of your 65th birthday month if your enrollment is completed during the first 3 months of your IEP. If your birthday is on the first of the month, your coverage begins the month prior. Your coverage start date may be delayed if you sign up later.

You may enroll in Medicare Part A, Part B, or both. You may also add additional coverage such as a Medicare Supplement and Prescription Drug Plan, or a Medicare Advantage plan. It highly encouraged that you enroll in a stand alone Prescription Drug Plan, or a Medicare Advantage plan with prescription coverage so that you may avoid any late enrollment penalties for Part D.

What are the different parts of Medicare?

Part A (Hospital Insurance): Covers inpatient hospital stays, skilled nursing facility care, hospice, and some health care

Part B (Medical Insurance): Covers doctors visits, outpatient care, preventive services, and rubble medical equipment.

Part C (Medicare Advantage): Offered by private insurance companies. Combines Part A and B, and often includes Part D and other extra benefits like dental, vision, and hearing.

Part D (Prescription Drug Coverage): Helps cover the cost of prescription drugs. Offered by private insurers approved by Medicare.

When can I enroll in Medicare?

You can enroll during your Initial Enrollment Period (IEP), which starts 3 months before the month you turn 65, includes your birth month, and ends 3 months after.

Other enrollment periods include:

Open Enrollment Period or OEP (Jan 1 – Mar 31)

Annual Enrollment Period or AEP (Oct 15 – Dec 7)

Special Enrollment Periods (SEP) for qualifying life events (e.g., losing employer coverage, moving to a new area, gain/loss of state assistance, etc.,)

Is Medicare Free?

Part A is usually free if you or your spouse paid Medicare taxes for at least 10 years or 40 quarters.

Part B has a monthly premium (most people pay the standard rate).

Part C and Part D have varying costs depending on the plan you choose.

Does Medicare cover dental, vision, and hearing?

Original Medicare does not cover most dental, vision, or hearing services. However, many Medicare Advantage plans do offer these as extra benefits.

Can I have both Medicare and employer insurance?

Yes. If you're still working past 65, Medicare can work alongside your employer coverage. Whether Medicare is primary or secondary depends on the size of your employer.

If your employer has less than 20 employees, then Medicare would be primary, and employer coverage secondary.

If your employer has more than 20 employees, then your employer coverage would be primary, and Medicare secondary.

Which is right for me, Medicare Advantage or Medicare Supplement?

With many options out there, it can be difficult to choose. The main things to consider when you're choosing are the following:

Are you comfortable choosing a health care provider from within a provider network or do you want to be able to choose any provider that accepts Medicare patients?

Would you rather have prescription drug coverage included in one plan or buy a separate Part D prescription drug plan?

Would you rather pay a low or $0 monthly premium and copays for in-network services as you use them or potentially pay more in monthly premiums and have lower out-of-pocket costs for services you receive?

We do not offer every plan available in your area. Currently we represent 9 organizations which offer 281 products in Texas. Please contact Medicare.gov, 1-800-MEDICARE, or your local State Health Insurance Program (SHIP) to get information on all of your options. Hoplite Agency LLC represents Medicare Advantage (HMO, PPO, and PFFS) organizations that have a Medicare contract. Enrollment depends on the plan's contract renewal. **Extra benefits require enrollment in an MA plan and depend on whether you are eligible to enroll in an MA plan in your area. Benefits are available only in select areas. Medicare Supplement insurance is available to those age 65 and older enrolled in Medicare Parts A and B and, in some states, to those under age 65 eligible for Medicare due to disability or End-Stage Renal disease. Medicare Supplement insurance plans are not connected with or endorsed by the U.S. government or the federal Medicare program. The purpose of this communication is the solicitation of insurance. Contact will be made by an insurance agent/producer or insurance company. Our licensed agents, who are independent contractors of Hoplite Agency LLC, are here to assist Medicare beneficiaries in understanding Medicare options. Additionally, this is a proprietary website and is not affiliated with, endorsed, or authorized by the Social Security Administration, the Department of Health and Human Services, or the Center for Medicare and Medicaid Services. Our site contains decision-support content and information related to Medicare services. To explore more about the Medicare program, please visit the Official U.S. government site for people with Medicare at

http://www.medicare.gov